portland oregon sales tax 2021

The County sales tax rate is. Oregon State Sales Tax information registration support.

Oregon Enacts Two New Local Income Taxes For Portland Metro Multnomah County Primepay

The City of Portland Revenue Division is now administering two new tax programs on behalf of their partners Oregon Metro and Multnomah County.

. Fig14 percent pop by income - Infogram. The Portland Oregon sales tax is NA the same as the Oregon state sales tax. Corporations exempt from the Oregon Corporation Excise Tax under ORS 317080 generally not-for-profit corporations unless subject to tax on unrelated business income.

Skip to main content. 425 max to sell a home in Salem and Bend. Supreme Court ruled a state may collect sales tax from taxpayers located outside the state if they are selling to state residents and there is a sufficient connection.

The Wayfair decision and online sales tax On June 21 2018 the US. Did South Dakota v. Following is an overview of.

In this report we look closely at households filing taxes jointly with 2018 personal incomes of 50000 75000 150000 and 300000 acknowledging that the median household income for our region is 78439. Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and. Sales Taxes In Oregon 2021 will sometimes glitch and take you a long time to try different solutions.

California 1 Utah 125 and Virginia 1. Five other citiesFremont Los Angeles and Oakland California. 100 Working Portland sales tax calculator Updated 2021 and providing the best and accurate results you can get non other than on 360 taxes.

Portland Oregon Sales Tax 2020 will sometimes glitch and take you a long time to try different solutions. In a time when our citys household budgets are already constrained due to. The sales tax in Portland Oregon is currently 75.

Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved problems and equip you. Metros Supportive Housing Services SHS Income Tax Program and Multnomah Countys Preschool for All Personal Income PFA Tax Program are effective January 1 2021. Income Tax Calculator.

Schedule K-1 or Form SP-2021 Combined Tax Return for Individuals if you have pass through income included in your Oregon Taxable Income that was subject to either the Multnomah County Business. The Sales tax rates may differ depending on the type of purchase. To file your personal income tax return s online you will need.

Portland OR Sales Tax Rate. City of Portland Revenue Bureau. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The Red Seal Two Dollar Bill. While many other states allow counties and other localities to. Portland Tourism Improvement District Sp.

Sales and use tax Retail ecommerce manufacturing software Consumer use tax. This rate is made up of a 65 state sales tax and a 10 local sales tax. Method to calculate Portland sales tax in 2021.

Start filing your tax return now. Integrate Vertex seamlessly to the systems you already use. Look up 2022 sales tax rates for Portland Pennsylvania and surrounding areas.

Over 2000 homes sold. View City Sales Tax Rates. Redmond OR Sales Tax Rate.

As of 2019 Portland had an estimated population of 654741 making it the 26th. The minimum combined 2022 sales tax rate for Portland Oregon is. Ad New State Sales Tax Registration.

Oregon is sales tax free and to boot has a lower cost of living compared to the national average. This is the total of state county and city sales tax rates. Tax rates are provided by Avalara and updated monthly.

Online Services We offer a variety of online services including business registration uploading tax pages filing a returnextension exemptions and payments. The Green Token Newbie In Cryptocurrency World. The Portland sales tax rate is.

Multnomah County passed a new measure in May 2021 that will impact property tax payers in Portland in 2022. The Oregon sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the OR state tax. 2020 rates included for use while preparing your income tax deduction.

Among major cities Tacoma Washington imposes the highest combined state and local sales tax rate at 1030 percent. View County Sales Tax Rates. The Connecticut sales tax rate is 635 the sales tax rates in cities may differ from 635 to 64.

What state has the highest sales tax. Historical Sales Tax Rates for Portland. Start filing your tax return now.

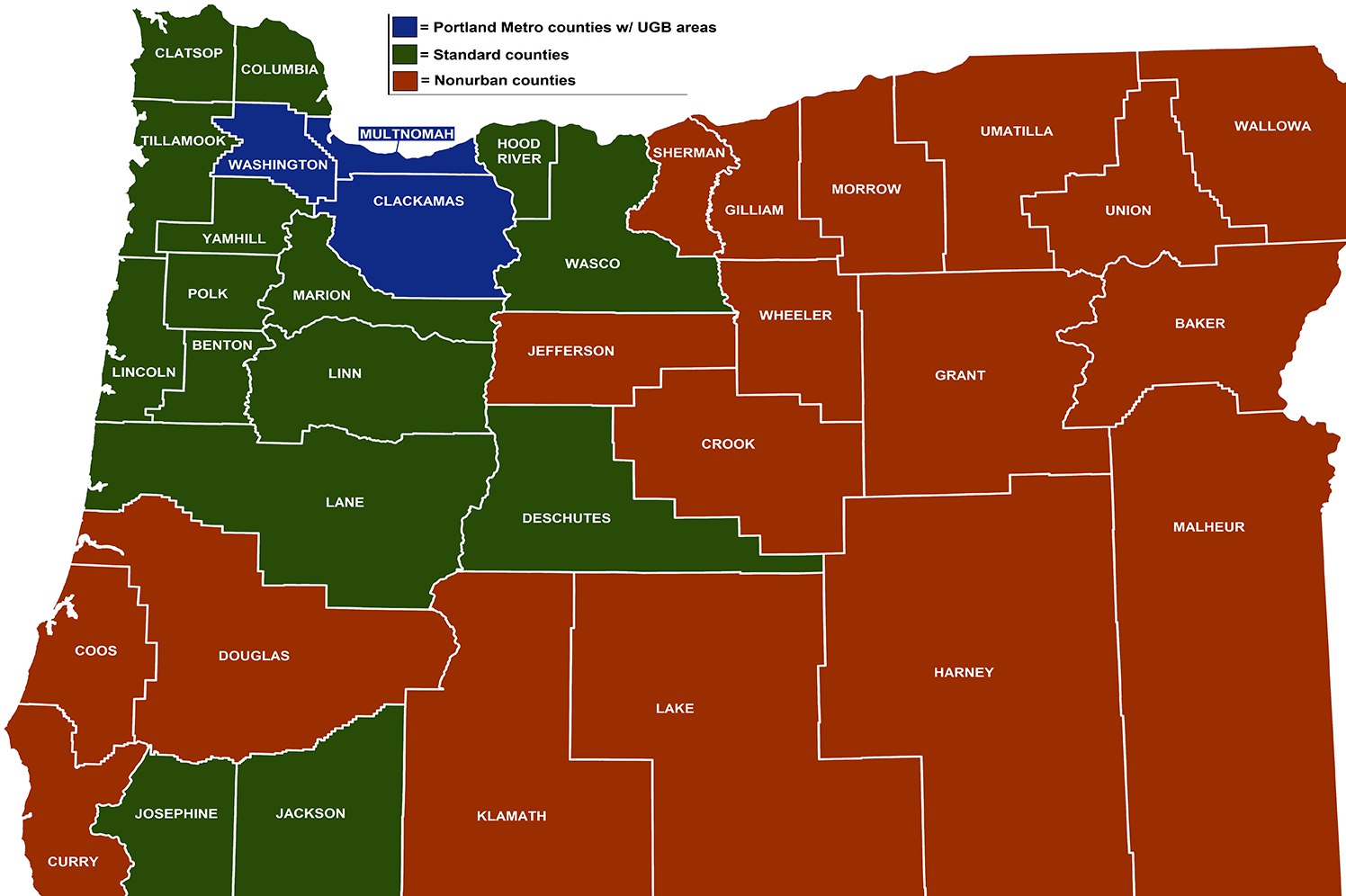

4 max to sell a home in Portland and SW Washington. Call his team in Oregon at 503-714-1111 or in Washington at 360-345-3833. Effective January 1 2021 two new Oregon local income taxes apply the Portland Metro Supportive Housing Services Income Tax and the Multnomah County Preschool for All Income TaxBeginning April 2021 employers are able to remit withholding tax payments and file returns for these new local taxes through the Portland Revenue Division.

Information about Portland Business License Tax Multnomah County Business Income Tax and Metro Supportive Housing Services. TAX DAY NOW MAY 17th - There are -434 days left until taxes are due. Form W-2 if you had Multnomah country PFA or Metro SHS tax withheld from your wages.

The local sales tax rate in Portland Oregon is 0 as of January 2022. No payment is due with the registration form. The Oregon sales tax rate is currently.

These rates are weighted by population to compute an average local tax rate. And Seattle Washingtonare tied for the second highest rate of 1025 percent. Business Registration Everyone doing business in Portland or Multnomah County is required to register.

Valley region of the Pacific Northwest at the confluence of the Willamette and Columbia rivers in Northwestern Oregon. A City county and municipal rates vary. Roseburg OR Sales Tax Rate.

The 2018 United States Supreme Court decision in South Dakota v. Rates include state county and city taxes. Birmingham Alabama at 10 percent rounds out the list of.

Last updated April 2022. A Principal Broker in Oregon Managing Broker in Washington he has been licensed since 2003 for residential real estate sales. The five states with the highest average combined state and local sales tax rates are Louisiana 955 percent Tennessee 9547 percent Arkansas 948 percent Washington 929 percent and Alabama.

The latest sales tax rates for cities in Oregon OR state. Wayfair Inc affect Oregon. B Three states levy mandatory statewide local add-on sales taxes at the state level.

LoginAsk is here to help you access Portland Oregon Sales Tax 2020 quickly and handle each specific case you encounter. TAX DAY NOW MAY 17th - There are -432 days left until taxes are due. This is in addition to the three new measures passed in November 2020 and the usual 3 increase Portland homeowners see every year.

Sales tax region name. Ad Automate Standardize Taxability on Sales and Purchase Transactions. Portland Property Taxes Going Up in 2022.

Additional measures could be voted on in November 2021 that. Oregon law doesnt allow you to reduce your Oregon taxes because you paid sales taxes in another state. The programs went live for withholding.

Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities. LoginAsk is here to help you access Sales Taxes In Oregon 2021 quickly and handle each specific case you encounter. State Local Sales Tax Rates As of January 1 2021.

Pin On For The Love Of The Us West Coast Oregon Travel Portland Travel Travel Usa

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Portland Oregon Learn About Life In And Around Portland Or Usa Pela

16 Best Things To Do In Portland Oregon Conde Nast Traveler

Pittock Mansion In Summer Oregon Mansions Visit Portland Portland Travel

City Guide Portland Oregon Go Next

Pin By Deb Zanghi On Books Monticello Best Sellers American

20 Honest Pros And Cons Of Living In Portland Oregon Tips

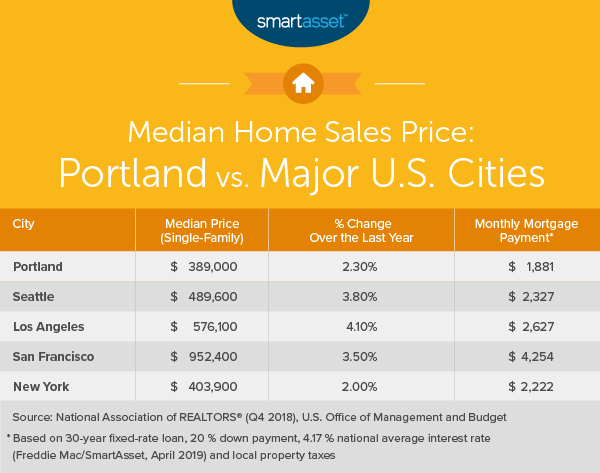

Cost Of Living In Portland Oregon Smartasset

Property Tax Bills To Be Mailed This Week At Least Small Increases In Store For Most In Portland Metro Oregonlive Com

Oregon State 2022 Taxes Forbes Advisor

/shutterstock_178351457-5bfc365646e0fb00517e18e7.jpg)

Taxes In Oregon For Small Business The Basics

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

The Top 10 Reasons To Move To Portland Or Home Money

Portland Oregon Travel Guide At Wikivoyage

/portland-oregon-downtown-cityscape-in-the-fall-181229873-578404d73df78c1e1f73a34e.jpg)